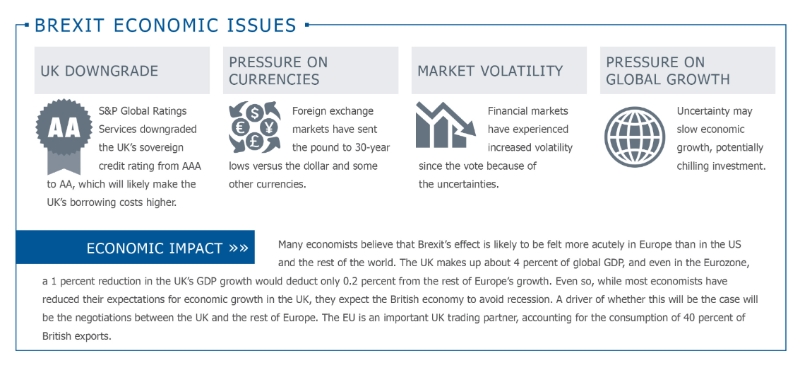

The UK vote to exit the EU (Brexit) has sent shudders through financial markets and created a cascade of political changes.

Our clients face an array of short-term challenges with foreign exchange volatility especially in the core currencies of the sterling, euro, and dollar. Many insurers had de-risked their investment portfolio because of the uncertainty of the vote, but those that did not will face pressure on their investments.

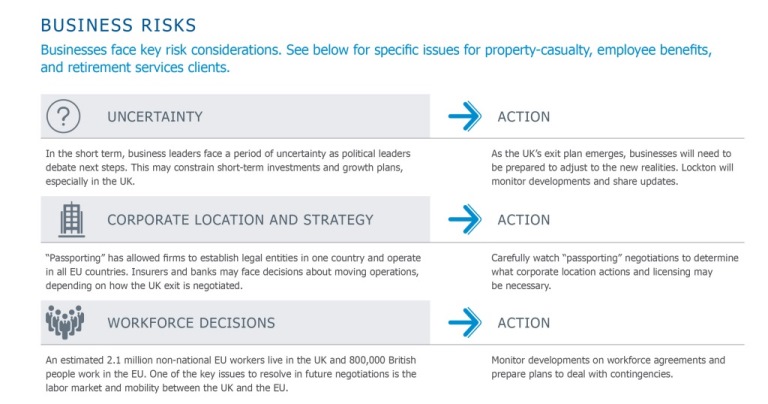

Additional impact on insurance markets is unclear and will likely not be settled for months. Prior to the referendum vote, the British Insurance Brokers' Association warned about the risks of a Brexit vote, suggesting that the current 'passporting' arrangements allowing EU insurers access to the UK market could cease, with the potential consequence of a significant reduction in choice and resultant increases in premiums. However, there are no immediate changes for insurers in the UK or in Continental Europe because the actual departure from the European Union will not occur for months or even years. This is a long and complicated process that will begin shortly.

The Departure Process

Under the Treaty on European Union, the two European legislative bodies, the European Parliament and the Council of the European Union, must vote on the departure. They have up to two years to negotiate the UK departure and vote.

Current Rules Apply

Commercial insurance buyers and their insurers currently benefit from the easy movement of business and people in the EU. The exit will lead to a period of uncertainty. But until negotiations are completed, the current business rules still apply.

Lockton's View

Lockton believes the change will create opportunities as well as risks for our clients, our insurer partners, and our business. The change will likely create new products, new corporate structures, and new businesses.

Lockton believes that the London market and Lloyd's will remain critical hubs in the insurance world. The rich depth of resources, expertise, and insurance capital have served clients well for centuries and will continue to do so.

This historic vote represents change. Our role at Lockton and in the insurance community is to help our clients respond effectively to change, manage risk, and seize opportunity. We will stand with our clients to help guide them through the issues as they emerge.

The order of the day is to remain steady and calm. There is no need to adjust insurance programs simply because of the June 23 vote. We will conduct ongoing analysis and share commentary as issues arise and decisions are taken to help our clients through the uncertainties.

Please contact your team at Lockton if we can help you further.